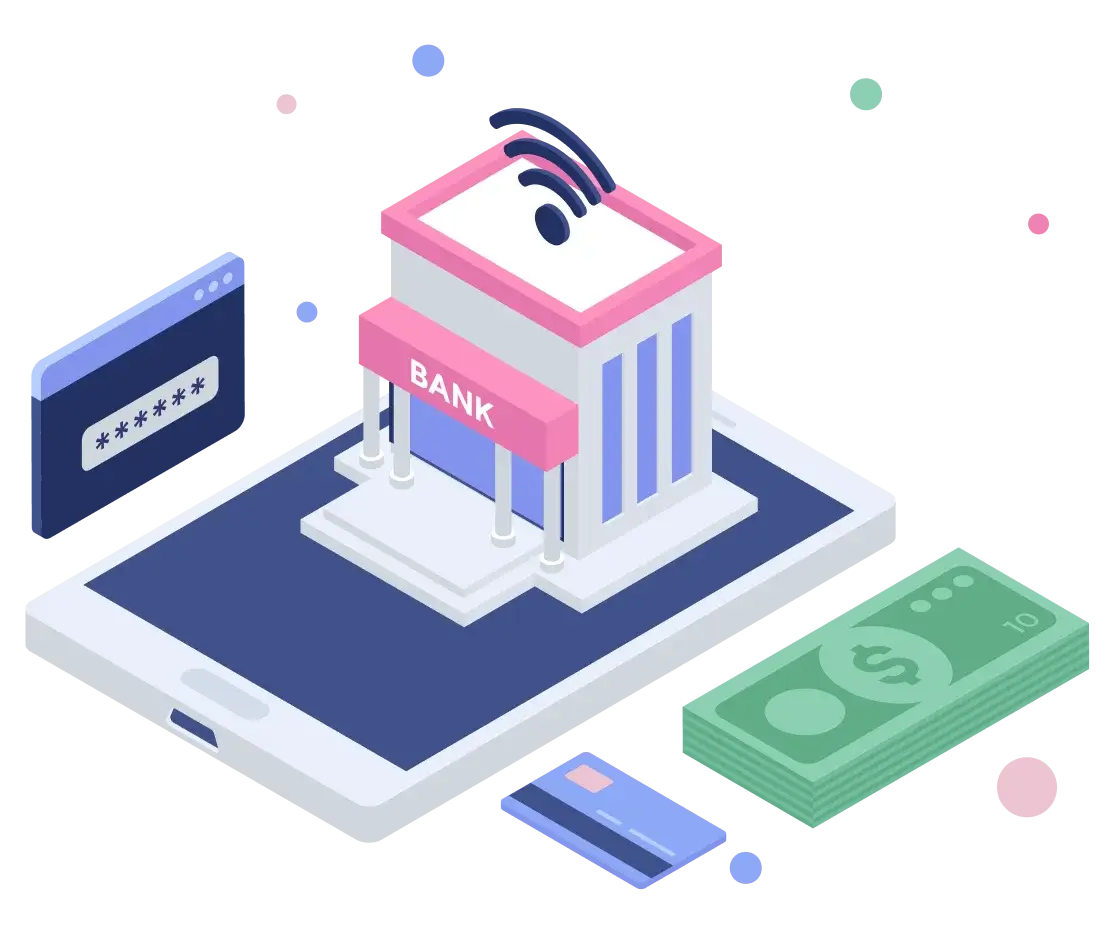

Blockchain is a decentralized digital ledger that records transactions securely and transparently. In banking, it’s used for cross-border payments, contract automation, fraud detection, identity verification, and regulatory compliance through tamper-proof records.

Empowering businesses with innovative tech for growth and global success